How Does Compound Interest Work?

Compound interest occurs when interest gets added to the principal amount invested and then the interest rate applies to the new (larger) principal. It’s essentially interest on interest, which over time leads to exponential growth.

Compounding can work to your advantage as your savings and investments grow over time. Learn more about how compound interest works and how it can affect your finances & life.

Say you put $10,000 into a savings account with a 7% interest rate that compounds annually. At the end of the first year, you’ll have $10,700 – the initial $10,000 in principal plus $700 in interest. That $700 is “simple” interest – interest based only on the principal amount invested.

At the end of the second year, you’ll have $11,449 – the $10,700 from the previous year plus $749 in added interest (7% of $10,700). Instead of calculating interest based only on your original principal, compounding interest calculates your annual interest based on the principal plus any previous interest you earned on that principal.

By the end of the 10th year, you’ll have $19,672, almost double your initial savings (without adding any more of your own money after your initial investment).

Thanks to compound interest.

Now we’ll look at the traditional investing results and then compare these to S-Group Forex Markt investing while also setting milestones of $100,000 each.

Investing $10,000 with an average yield of 7% per year.

- the first $100.000 will take you 35 years

- the second $100.000 only take 10 years

- the third $100.000 6 years

- the fourth $100.000 4 years

- the fifth only 3 years etc.

↓ EXEMPLARY CALCULATIONS ↓

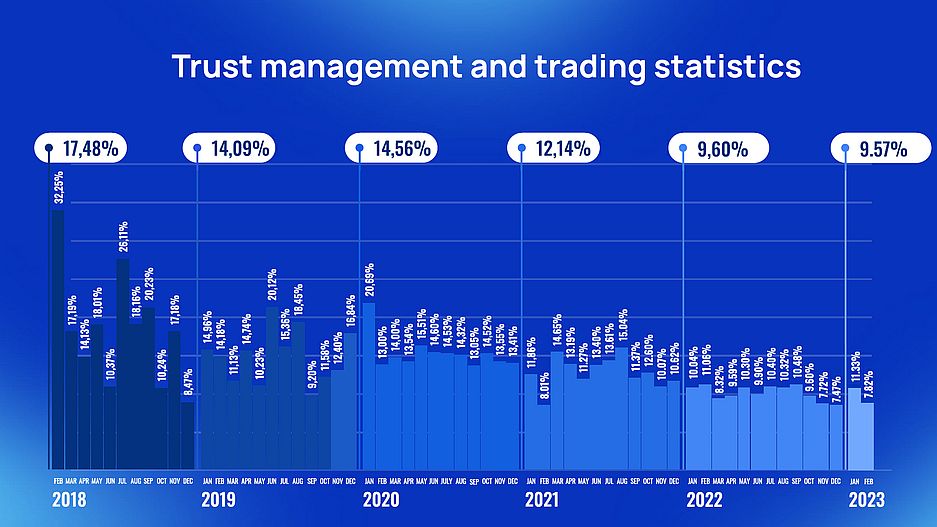

!! Now we’ll compare this to the S-Group Forex results, based on the average monthly percentages.

↓ EXEMPLARY CALCULATIONS ↓

Congratulations! You’ve just learned what compound interest is, how it works and seen the powerful results of S-Group’s Forex Market Trading.